How Much Money Is Enough In My Bank Account As Retirement Corpus If I Decide To Quit Active Professional Life Someday ?

Almost a year back, I met some of my old-time friends ( going back 20 years or so) for lunch. It was like a get together of 40+ year old men who were meeting after two long decades to catch up like bachelors. The meeting started with lunch and went on to dinner late in the night. The topic of discussion varied from how we all started our life at the same work place when we were just in our early 20s and never imagined that we can make money enough to afford luxurious restaurants and fancy cars with multiple trips abroad. We made fun of each other on how we struggled, borrowed the money from each and never paid back till date. The amounts in discussion were laughable in today’s time ( like Rs 300 or so ) but in those times, it became a matter of survival. The fun continued for long…

But by dinner, the discussion became a bit serious. The same people who were having fun discussing the past, now became serious discussing the future. Out of nowhere, one guy started talking about retirement. And lo and behold, here were five 40+ men who had no clue about “retirement”. Retirement as a concept was always in our minds but it never occurred to us that we had crossed our equator (or half life) of our professional life. All of us knew that people retire and saw our parents retiring from work. We all saved money but never saved the money thinking that we’ll stop working one day either by choice or by force.

So, One of my friends started the discussion saying that to live a decent life with moderate lifestyle, Rs. 1,00,000 a month is enough. Then, the debate started on the definition of “decent lifestyle”. What was “good enough” for one was “not good enough” for another. Even the basic amount of currently monthly expense varied for each of us. While the discussion started heating up, another friend of mine said that it is good enough to have a corpus of INR 1 crore ( INR 10 million).

And suddenly, every one turned into an expert economist talking about terms like GDP, inflation, rising school fees, rising fuel prices, and at the same time, rising income etc. I was one of those expert economists too who didn’t even know the service tax we pay on the food that we were eating. But then, in a group of five 40+ year old men, who dares to say that I don’t know shit about economy. Anyway, the discussion progressed, everyone left after dinner and soon we forgot about our retirement discussions.

Now, with the Corona Virus spread across globe, I’ve ended up working from home for more than a month. With this COVID19 discussions on WhatsApp groups and online forums, there is another discussion happening, and that’s about RECESSION and UNEMPLOYMENT. I have been reading news about people getting fired from jobs across the world ( including India). Salaries are being cut significantly. People are being furloughed or asked to go on unpaid leaves. Supply chain is in trouble. Demand is falling down due to people staying home and are in lockdown situations.

While all this is temporary and being an optimist, I believe that things will be back on track sooner than later, It made me think about my future. And I thought what will happen If I lose my job or I am not able to work. While working at home, I noticed that I was working much harder and much longer hours that I worked while being in office. I started thinking that If I don’t feel like working one day and want to follow the FIRE ( Financially Independent, Retire Early) theory, how much money do I need in my account so that I don’t have to go back to work or live below the level that I live currently.

I started thinking about it and applied some of my excel skills ( along with some basic 10th standard maths) to calculate what should be my retirement corpus. And to achieve that, what should be the monthly amount of money I should start saving to build a savings portfolio and achieve my goals of a peaceful retired life ( following the FIRE philosophy)

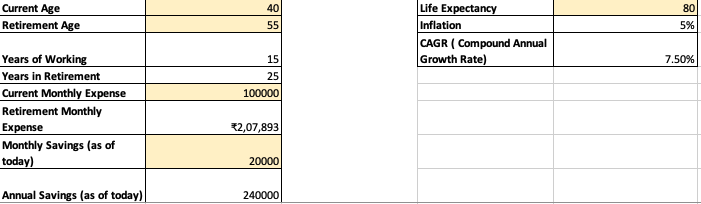

So, After a few hours of work, I came up with this simple excel sheet that helped me visualise my future requirement of money.

Retirement Corpus Calculator : Click here to download the Microsoft Excel File

for example : If I have a monthly expense of INR 1 Lakh ( INR 1,00,000) , then after 15 years when I retire, my monthly expense will be more than INR 2 Lakh ( INR 2,07,893)

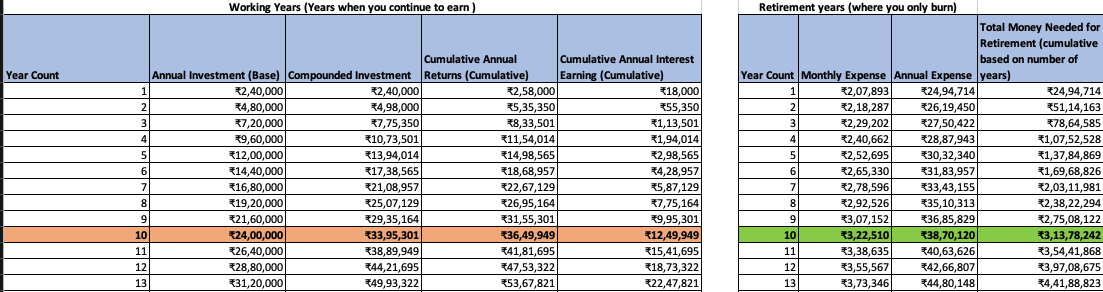

and then, I can see some of the following calcutions for generating a pattern of my savings and my expenses after retirement.

And the results were astonishing. I was laughing at myself thinking that the amount that looks so big today can be a meagre amount in a decade or so. For example : 10 years ago, Rs. 100/- could buy you 10 litres of milk or 5 loafs of bread. Today, the same Rs. 100/- gets you only 2.5 litres or less of milk and may be 2 or 3 loafs of bread. It seems, prices have more than doubled in 10 years or so.

So, I was laughing at myself thinking how foolish I was not to notice the compounding effect of inflation on the prices in years while being an “expert armchair economist” discussing the GDP and economic policies of India.

We, generally, don’t notice it today. But think that if this recession stays longer than required and has the same impact like the “great depression” during the 1930s, our earnings will go for a toss. Leave the increments aside, we may not have enough for current lifestyle too and that can set us back by few years of savings, in turn, making us work longer than required number of years to achieve our goals.

While it may seem simple to you today, it is not that straightforward to plan for retirement. Most of the Indian IT workforce has never seen retirement and the first generation of IT industry in India is getting into retirement zone in this new decade. So, the Indians who caused the IT revolution and started a trend of high income or high salaries along with foreign travels are yet to see the effect of retirement and did they save enough or not.

I don’t have much to say, but wanted to make people aware of the impact of economy and recession and how things can possibly play out. It’s better to plan and have a visibility into what lies ahead. Based on this, you should be able to plan your investment strategies, insurances, mediclaim policies etc.

Here is the link again : Retirement Corpus Calculator : Click here to download the Microsoft Excel File

Let me know what you think of this calculator. Like and share this article on social media (LinkedIn, Facebook, Twitter or anything else that you use) if you think this calculator really helped you visualise your retirement and help you calculate the corpus you may need.